FedNow & Real-Time

Payments

Solutions

Online integrated Origination, Sending, Receiving and Recordation of all Good Funds Transfers.

"All participants receive instant real-time electronic notifications. Use our online Payment Gateway interface or integrate your in-house system with our API"

More infoCredit Card Processing

Retail Face-to-Face

Mail Order Telephone Order

eCommerce Internet Sales

eMail Invoicing

Check Processing

Online Reporting with Images

Stop Going to the Bank

Next Day Funding

Check 21 - Remotely Create Checks

Electronic Check

Real-time Payments FedNow Processing Merchant Account

What is Real-time Payments FedNow Processing Merchant Account

A Real-time Payments FedNow Processing Merchant Account enables businesses to receive instant payments directly into their bank accounts, 24/7, using the Federal Reserve’s FedNow service. This account type is ideal for B2B and C2B transactions across all channels—MOTO, POS, and eCommerce—offering faster settlement times, improved cash flow, and reduced transaction costs. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank, B2B, B2C and C2B account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions.

Real-time Payments FedNow Processing Merchant Account for your business using Real-Time Payments

Using a Real-time Payments (RTP) Merchant Processing Account provides substantial benefits for B2B and C2B transactions across Mail Order/Telephone Order (MOTO), Point of Sale (POS), and eCommerce channels:

1. Immediate Access to Funds

- With real-time payments, funds settle instantly, 24/7, offering businesses immediate cash flow, crucial for managing operational expenses or urgent payments to vendors and suppliers.

2. Enhanced Customer Satisfaction

- Real-time payments create a faster, more convenient experience for customers who appreciate seeing immediate confirmation of completed transactions, reducing payment uncertainties.

3. Lower Processing Costs

- RTP can be more cost-effective than traditional credit card payments, especially for large or high-frequency transactions, saving businesses on fees and reducing operational costs.

4. Improved Cash Flow Management

- Instant settlement helps businesses better manage and predict cash flow, making it easier to handle expenses, payroll, and inventory replenishment without waiting for funds to clear.

5. Versatile for All Payment Channels

- MOTO: Eliminates delays associated with traditional payments, ensuring quick access to funds from remote transactions.

- POS: Allows customers to pay directly from their bank accounts at physical locations, bypassing card fees and offering an efficient alternative for large transactions.

- eCommerce: Provides an option for instant, secure transactions, reducing cart abandonment and enabling faster order processing.

6. Reduced Risk of Fraud and Chargebacks

- Real-time payments offer enhanced security measures, reducing the risk of fraud and chargebacks often associated with card-not-present transactions, particularly valuable for eCommerce and MOTO channels.

A Real-time Payments Merchant Processing Account supports faster, more secure, and cost-effective transactions, making it ideal for businesses looking to enhance efficiency across various payment channels in both B2B and C2B markets.

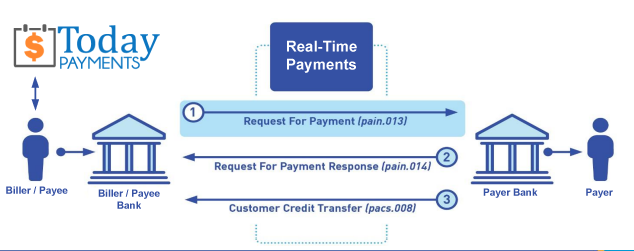

Creation Request for Payment Bank File

Call us, the .csv and or .xml Real-Time Payments (RTP) or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Contact Us for Request For Payment payment processing